How much do people in the many countries of the world earn, how much disposable income — the bit that’s left over after all the bills are paid — do they have, and what if anything, do they do with it?

It’s not easy to find out, as there are 195 countries scattered around the planet, and some of them are not even officially recognised as countries at all (the State of Palestine, for example, and the officially “disputed territory” of Western Sahara too). So how do we find out? A good place to start is with the OECD — the Organisation for Economic Co-operation and Development — a global intergovernmental body that regularly compiles data on average earnings and disposable income among its 36 member nations.

These are mostly high-income countries in Europe, the Americas, Australia, New Zealand, and Japan, the sole economic powerhouse in Asia and one that, unlike neighbouring and rising power China, is fully developed and considered a mature economy. Other regions have their own intergovernmental organisations to help spur along their economies and overall development, including the Association of Southeast Asian Nations, the African Union, the Union of South American Nations, and the Latin American and Caribbean Economic System, some, if not all, of which draw on data from the International Monetary Fund to compile statistics on their populations’ earnings, outgoings, and spending.

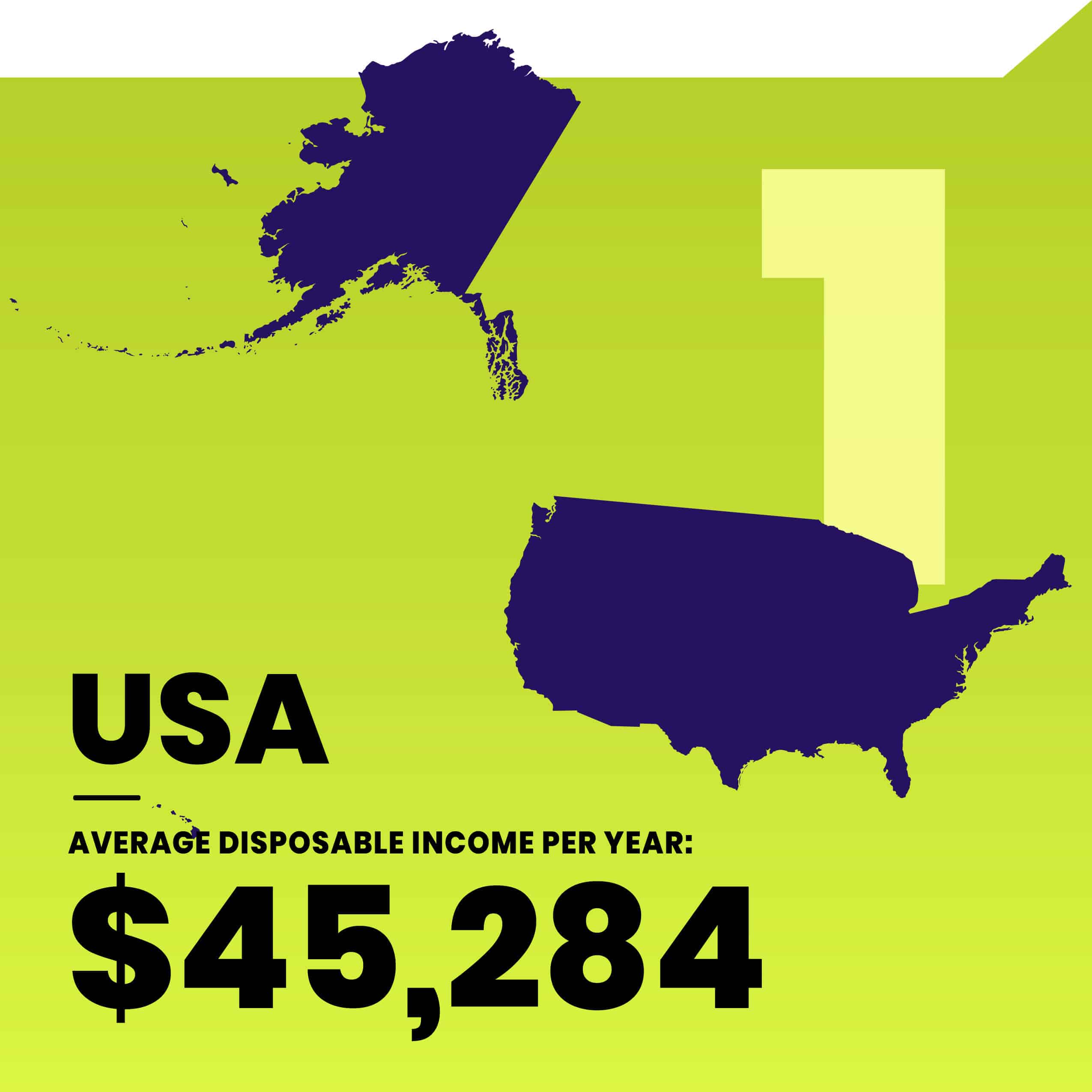

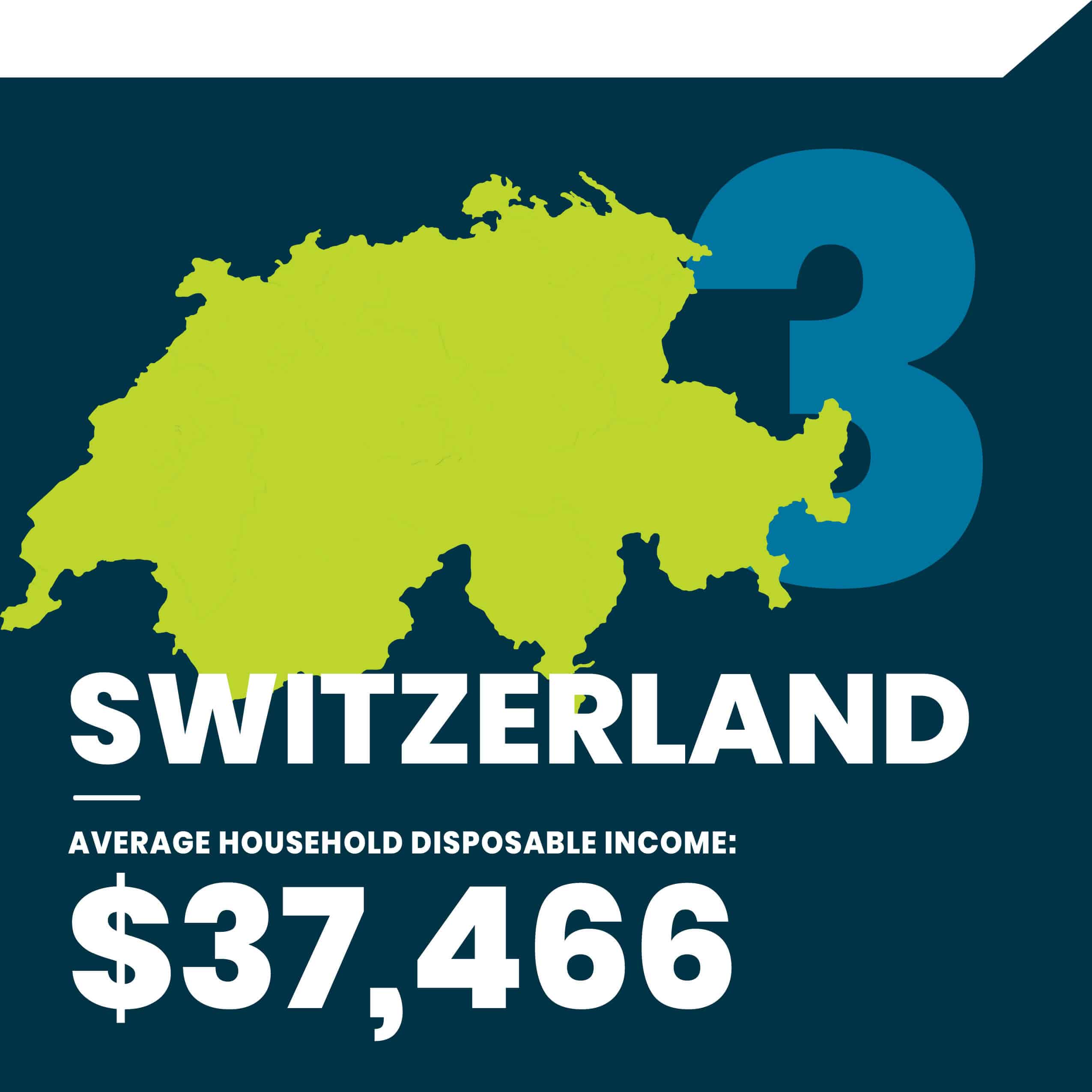

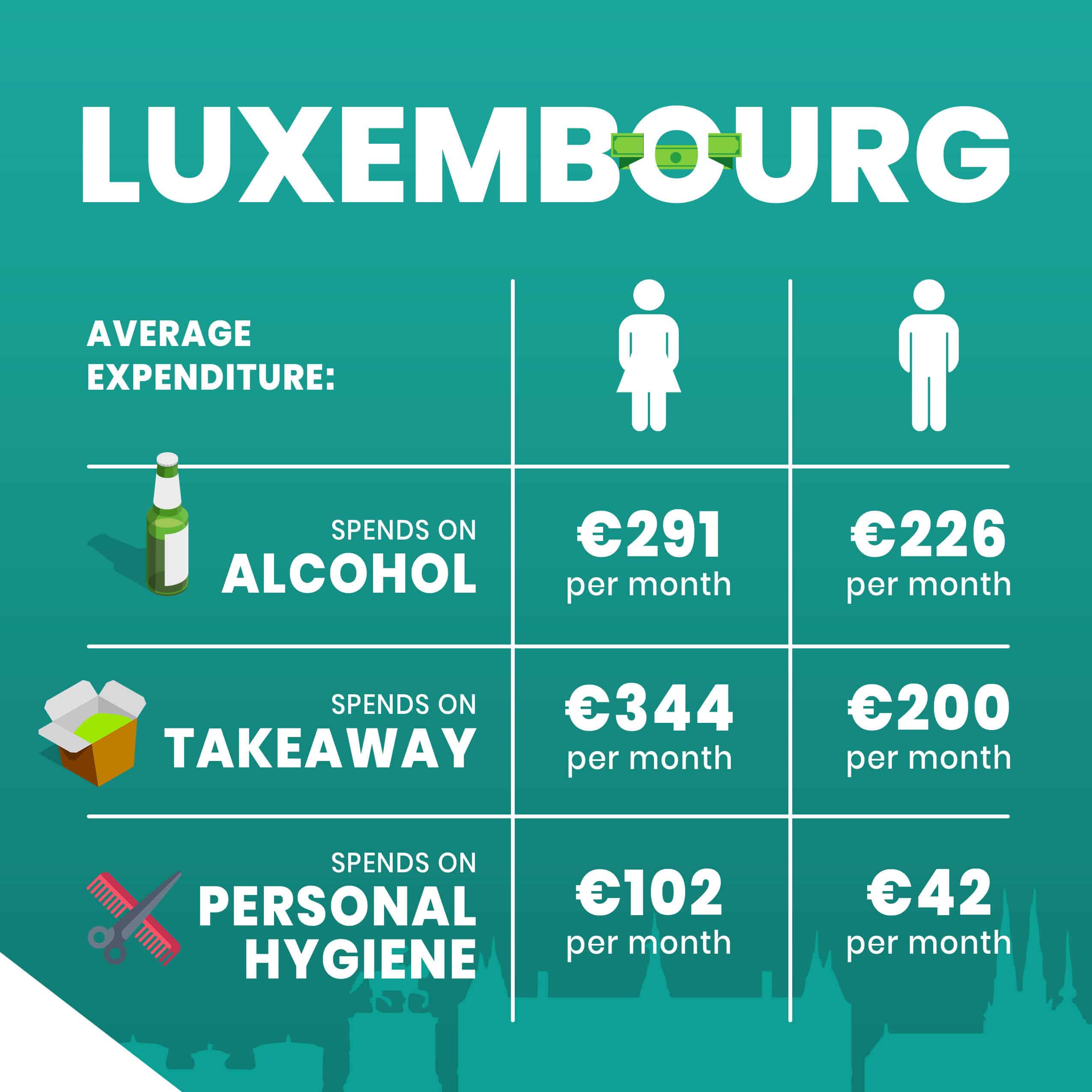

The latest figures from the OECD, for its Better Life Index, which is updated every couple of years, tell us that across the organisation’s members, the average disposable income per capita is US$30,563 a year — and that, perhaps unsurprisingly, economic superpower the United States is in top position with $45,284 average disposable income per year. Next is the tiny European nation of Luxembourg, with $39,264, and in third place is equally wealthy Switzerland, with $37,466 in average household disposable income.